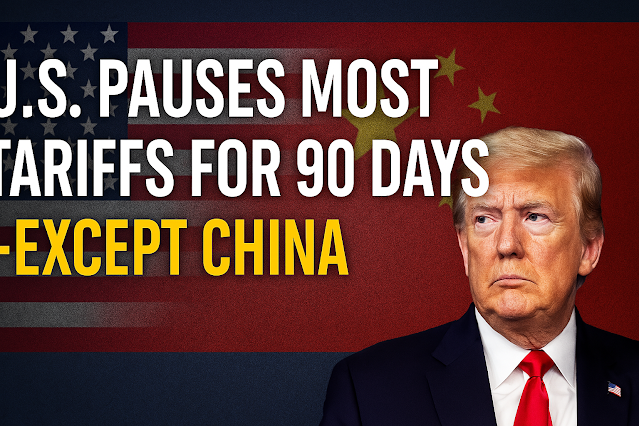

In early April 2025, the United States made a significant shift in its trade policy by announcing a 90-day suspension of most newly implemented tariffs. This move, framed as a temporary recalibration rather than a full retreat, was intended to reduce market tension and stabilize the global economic landscape. President Donald Trump declared that the tariff rate would be lowered to 10% for a majority of U.S. trading partners—provided they had not retaliated against earlier U.S. trade actions. Yet notably, China was excluded from this reprieve, with the administration ramping up tariffs on Chinese imports to a staggering 125%.

The Broader Context Behind the 90-Day Pause

This decision came amid growing unease within financial markets and increasing pushback from domestic business leaders and lawmakers. Many had begun to express concerns about the economic ripple effects of the rapidly escalating trade war. Supply chains were under pressure, commodity prices were rising, and key industries such as agriculture, manufacturing, and technology faced mounting uncertainties.

The 90-day pause was seen as an attempt to defuse some of this pressure without compromising the administration’s broader trade agenda. By granting a temporary reprieve to countries deemed cooperative or neutral, the U.S. aimed to reward diplomatic trade behavior and incentivize continued negotiations. Over 75 countries were included in this pause, with the administration highlighting their willingness to work toward “fairer and more reciprocal” trade deals.

Why China Was Treated Differently

China's exclusion from the tariff suspension wasn’t a surprise to many trade analysts. The U.S. and China have been locked in a prolonged economic rivalry that goes far beyond simple trade balances. Key issues at the heart of this conflict include the protection of intellectual property, state subsidies to Chinese industries, forced technology transfers, and limited market access for foreign firms operating in China.

The Trump administration accused China of acting in bad faith during previous negotiations and of retaliating with what it called "disproportionate" tariffs on American products. The response—a sharp tariff increase to 125% on Chinese imports—was designed to send a strong message to Beijing. Rather than de-escalating with China, the White House doubled down, betting that economic pressure would bring Chinese leaders back to the negotiating table with more urgency and fewer demands.

Economic Fallout and Market Responses

Financial markets reacted quickly and dramatically to the announcement. Wall Street soared, with the Dow Jones Industrial Average logging its biggest-ever one-day points gain. Investors, who had been bracing for a prolonged period of global trade uncertainty, took the pause as a sign that the worst-case scenario might be avoided—at least temporarily.

The technology sector led the surge, particularly firms with global supply chains that stood to benefit from the reduced trade friction. U.S. agricultural commodities also saw a bump, as farmers and exporters anticipated more open access to global markets outside of China. However, not all sectors benefited. American firms heavily dependent on Chinese manufacturing continued to worry about cost increases and supply disruptions due to the continuing tariff battle with Beijing.

Global Reactions and Diplomatic Calculations

International responses to the U.S. tariff pause were mixed. Allies in Europe and Asia welcomed the move, interpreting it as an opening for further trade discussions. Many governments had been seeking ways to avoid getting caught in the crossfire of a U.S.-China economic standoff and saw the pause as a reprieve from collateral damage.

At the same time, the exclusion of China raised concerns about the long-term direction of U.S. trade policy. Economists and foreign diplomats warned that isolating one of the world’s largest economies could lead to fragmented global trade systems, where countries were forced to choose between aligning with U.S. or Chinese trade blocs. Some even feared the move might escalate into a broader economic cold war.

Domestic Political Considerations

From a political standpoint, the Trump administration’s move had strategic value. Domestically, it allowed the president to maintain a tough-on-China posture, which played well with his base, while simultaneously alleviating pressure from businesses and farmers ahead of a crucial election cycle. By selectively easing tariffs, Trump could present himself as flexible yet firm—an image that has long been central to his political branding.

Senate Republicans were quick to praise the move, calling it a “common-sense step” to support the American economy. Behind closed doors, many lawmakers had grown increasingly anxious about the tariff policies’ effects on constituents and campaign donors. The pause gave them breathing room and a narrative they could sell back home. Democrats, however, remained critical. Several leaders characterized the administration’s approach as erratic and warned that lurching between aggressive tariffs and sudden pauses would create long-term uncertainty.

Looking Ahead: What Comes After the 90 Days?

The real test for U.S. trade policy will come after the 90-day window expires. The administration has not ruled out reapplying tariffs or even expanding them if negotiations do not lead to the outcomes it desires. Much will depend on how other nations, particularly China, respond in the coming weeks.

If China remains unyielding or escalates its own countermeasures, the economic conflict could deepen. American companies may find themselves trapped in an unstable global environment, facing supply chain disruptions and diminished export opportunities. Conversely, if the pause leads to meaningful diplomatic breakthroughs, it could mark a turning point in global trade relations.

Either way, the U.S. decision to differentiate its treatment of China from the rest of the world signals a pivotal moment in modern economic history—one that may reshape global trade norms for years to come.

.jpeg)

.jpg)

0 Comments